Uber Technologies, Inc. experienced a noteworthy yet complex response from investors following its recent fourth-quarter earnings announcement. While the company showcased its revenue growth by surpassing analysts’ expectations, it simultaneously presented a less optimistic outlook that led to a significant drop in its stock price, approximately 7% in premarket trading. The revenue recorded for the fourth quarter reached an impressive $11.96 billion, eclipsing the expected $11.77 billion forecasted by LSEG. Despite this positive development, concerns arose from weaker forward guidance, compelling investors to reassess the company’s future trajectory.

Uber’s net income demonstrated a striking increase, reported at $6.9 billion, translating to earnings per share (EPS) of $3.21. This marks a substantial climb from the previous year’s fourth quarter, where net income was only $1.4 billion, or 66 cents per share. However, it’s crucial to note that this surge was partly due to a $6.4 billion gain from a tax valuation release, alongside a $556 million pre-tax benefit linked to equity investments. This raises questions about the sustainability of such earnings, as the underlying business may not be as robust without these extraordinary items.

While on the surface, these figures indicate strong performance, investors must be cautious. A closer analysis reveals that adjusting for one-time benefits gives a more nuanced picture of profitability and operational efficiency. This brings attention to the need for ongoing revenue generation and cost management in the face of rising operational complexities.

Another key performance indicator worth mentioning is the achievement of $44.2 billion in gross bookings for the fourth quarter, exceeding the anticipated $43.49 billion. This level of activity indicates a healthy demand for Uber’s services. The ride-sharing giant facilitated approximately 3.1 billion trips during the quarter, representing an impressive 18% year-over-year growth. Moreover, the company expanded its user base, reaching 171 million monthly active users, which is a 14% increase from the previous year.

However, it’s essential to scrutinize how sustainable this growth is. The global ride-sharing market has become increasingly competitive, putting pressure on Uber to maintain its market share and respond to evolving consumer preferences. Therefore, while these figures are encouraging, the company must continue to innovate and enhance user experience to retain and grow its customer base.

Examining Uber’s various business segments reveals a substantial 18% year-over-year increase in mobility gross bookings, reaching $22.8 billion, with revenue rising to $6.91 billion—surpassing analysts’ estimates. In contrast, the delivery segment (Uber Eats) also experienced a commendable 21% surge in revenue, totaling $3.77 billion.

Nonetheless, Uber’s freight business maintained a static revenue of $1.28 billion, which aligns with last year’s figures but fell short of expectations. This stagnation highlights ongoing challenges in the logistics segment, particularly as consumer spending behavior shifts toward services rather than goods—a trend amplified by the pandemic. As such, Uber’s freight segment may require strategic reevaluation and potential restructuring to drive growth in this area.

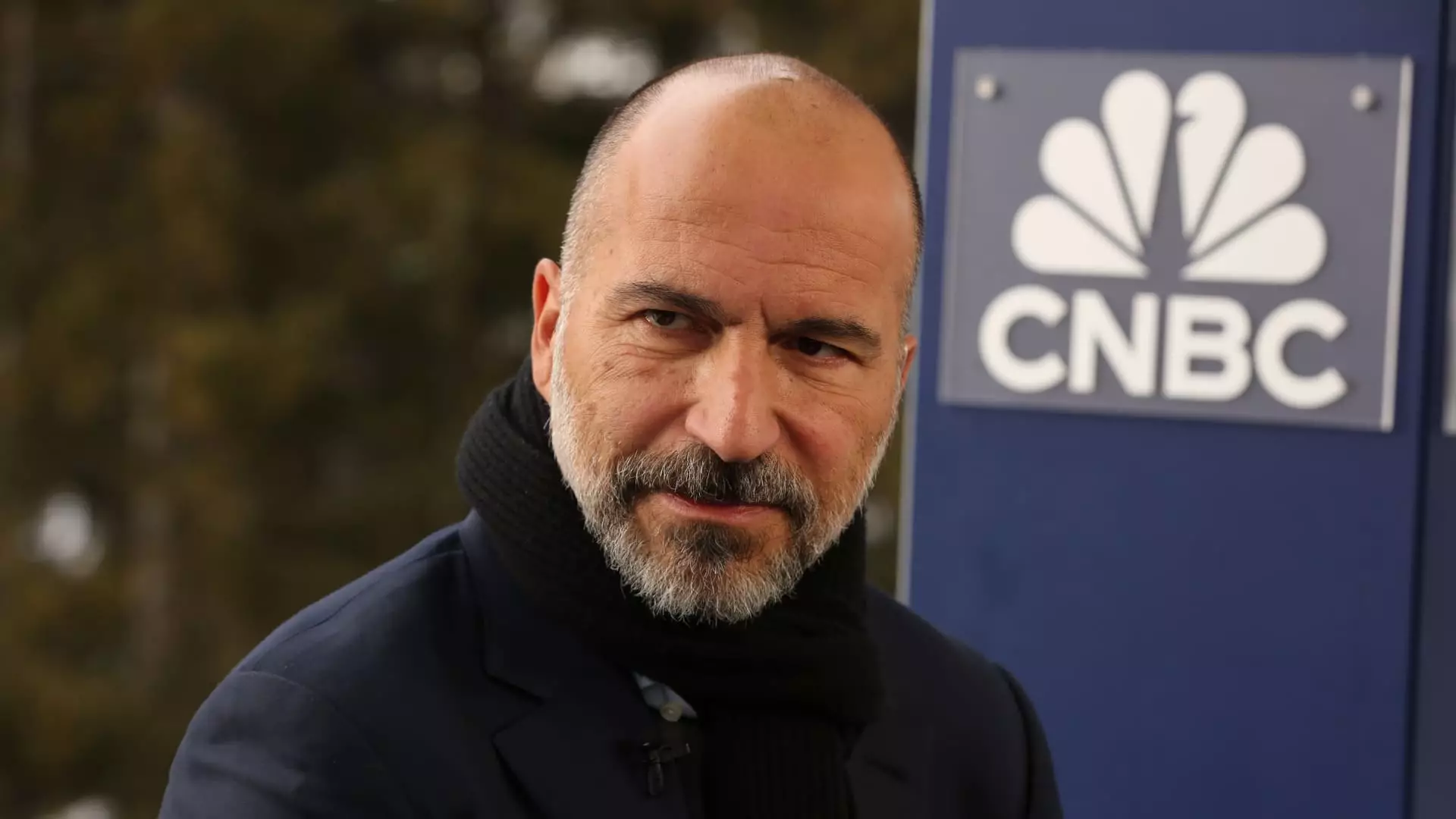

Looking ahead, Uber’s guidance for the first quarter indicates gross bookings projected between $42 billion and $43.5 billion, slightly falling below analyst expectations. Furthermore, its adjusted EBITDA forecast of $1.79 billion to $1.89 billion also hints at cautious sentiment. CEO Dara Khosrowshahi emphasized the company’s commitment to innovation, particularly in the burgeoning field of autonomous vehicle technology, as it prepares for a public launch of robotaxi rides in Austin, Texas—an initiative aimed at unlocking new revenue streams.

However, the success of this venture hinges on technological advancements, regulatory approvals, and consumer acceptance, presenting both opportunities and hurdles. As Uber forges ahead, a delicate balance between innovation and addressing underlying operational challenges will be imperative for sustaining its leadership in the fiercely competitive ride-sharing market.

While Uber’s fourth-quarter results may reveal impressive metrics on many fronts, a holistic view underscores the importance of approaching these figures with caution. The company’s future growth prospects depend on its ability to navigate a complex landscape incrementally while ensuring operational excellence and meeting evolving consumer demands.