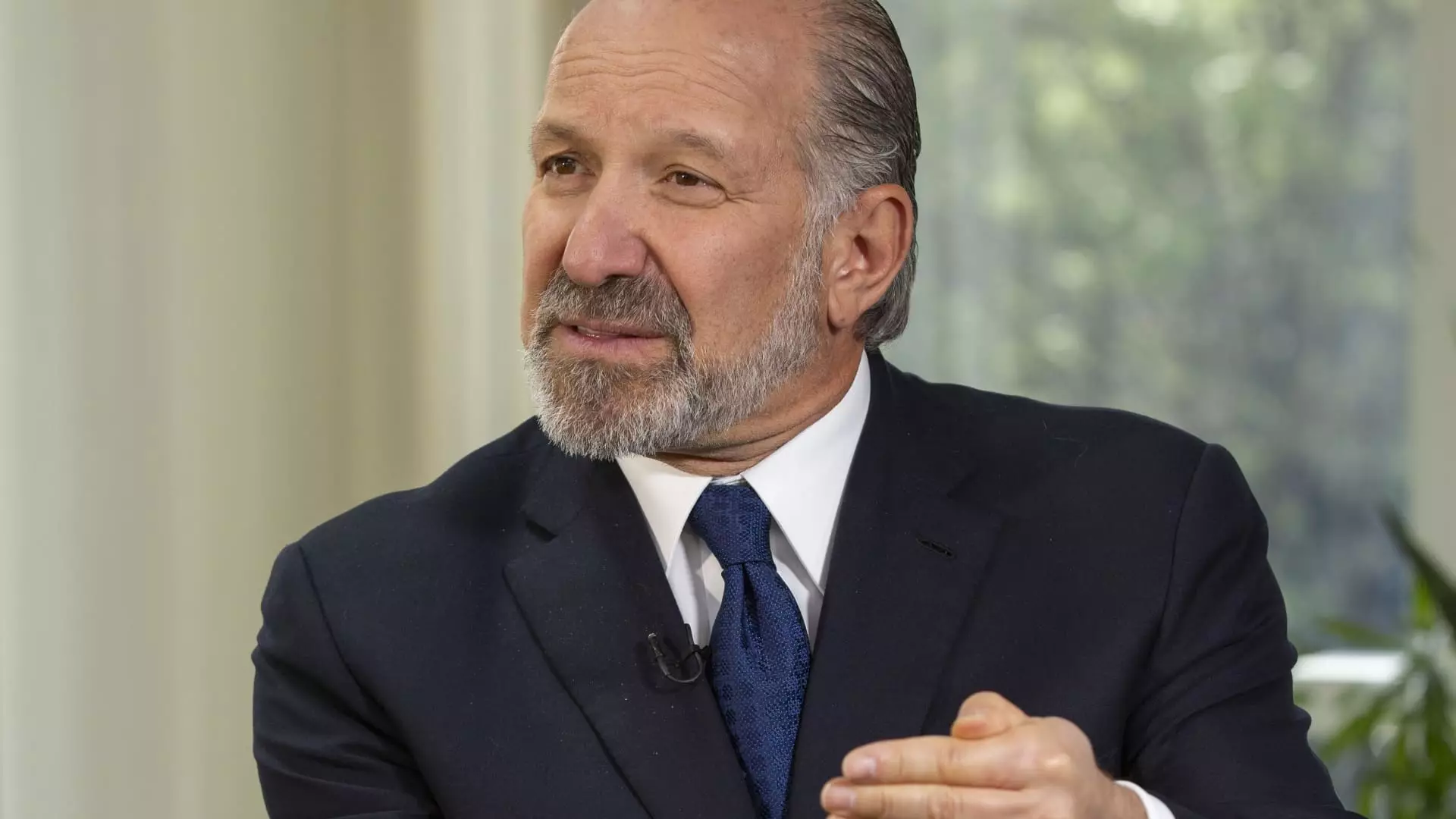

In the complex landscape of technological dominance, the United States faces a pivotal crossroads. Recent debates surrounding the allocation of funds for domestic chip manufacturing reveal a fundamental question: Should the government practically act as a venture capitalist, demanding stake in the companies it champions? The proposal from Commerce Secretary Howard Lutnick to acquire equity in Intel in exchange for the CHIPS Act investments is both daring and provocative. This stance shifts the conventional paradigm, which has traditionally leaned towards grants and subsidies without any ownership rights. By advocating for equity stakes, the administration appears to recognize the necessity of aligning national interests with corporate ambitions—a strategic recalibration that could redefine public-private collaboration in the tech domain.

This approach reflects an understanding that simply doling out taxpayer dollars isn’t sufficient to ensure long-term dominance. Instead, it suggests an effort to embed the government’s influence more tangibly within the industry. If successful, this model could serve as a blueprint for future investments, ensuring that state resources generate not just economic returns but also strategic leverage. However, critics may argue that such a move risks politicizing corporate governance and complicating operational independence. Yet, in an era where technology sovereignty is vital, the potential benefits of gaining influence over critical supply chains outweigh the traditional reticence associated with equity participation.

Strategic Calculations Amid Geopolitical Tensions

The unfolding discussion about the U.S. government’s involvement with Intel and other chipmakers underscores a broader geopolitical contest. The potential acquisition of a significant stake—perhaps even becoming the largest shareholder—would dramatically alter the industrial landscape. It raises profound questions about the nature of public interest: Is the government simply a cheerleader for private enterprise, or a proactive stakeholder shaping the future of American innovation?

Recent moves, such as SoftBank’s $2 billion investment, hint at a battle for influence, where private capital and government interests intersect. The divergence in perspectives—Lutnick’s emphasis on non-voting shares to sidestep governance complications—highlights a nuanced strategy to balance influence with operational independence. This delicate dance reflects a broader tension between national security imperatives and entrepreneurial freedom. While some analysts view such tactics as pragmatic, others see them as provocative attempts to establish control without overt intervention. Either way, the stakes are high, and the outcome could set a precedent for future government involvement in strategic sectors.

Furthermore, the current landscape illustrates an ideological divide between administrations. While the Biden policy seemingly favors unconditional grants, the proposed shift under Trump’s approach of demanding equity stakes signals a more aggressive strategy—akin to a strategic takeover to safeguard national interests. Such moves could recalibrate the entire industry’s structure, effectively transforming the U.S. into a significant stakeholder, and possibly a controller, of vital technological assets.

The Cultural and Economic Implications of Strategic Ownership

Changing the nature of public investments from grants to equity stakes also has profound cultural meanings. It signifies a more assertive stance—one that refuses to treat public funds as mere philanthropy but as a form of strategic investment. This philosophical shift could reframe how the industry perceives government support, transforming it from a passive benefactor into an active partner with vested interests.

Economically, such a model aims to maximize returns for taxpayers, ensuring that government funding translates into direct benefits—whether in the form of shareholder value, intellectual property, or technological sovereignty. Yet, the challenge lies in managing these stakes without compromising the efficiency and innovation capacity of private firms. The delicate balance involves enabling strategic influence without stifling corporate agility—a feat that requires nuanced policy crafting and careful oversight.

The debate reflects a broader, more fundamental question about how nations should secure their technological futures. Should the U.S. adopt more interventionist tactics akin to state capitalism, or continue to favor a free-market approach with limited government meddling? The current discourse suggests that a hybrid model—where strategic stakes serve as both economic and geopolitical tools—might offer the most pragmatic pathway forward. Ultimately, embracing this bold strategy could redefine the very fabric of America’s technological ascendancy in the coming decades.