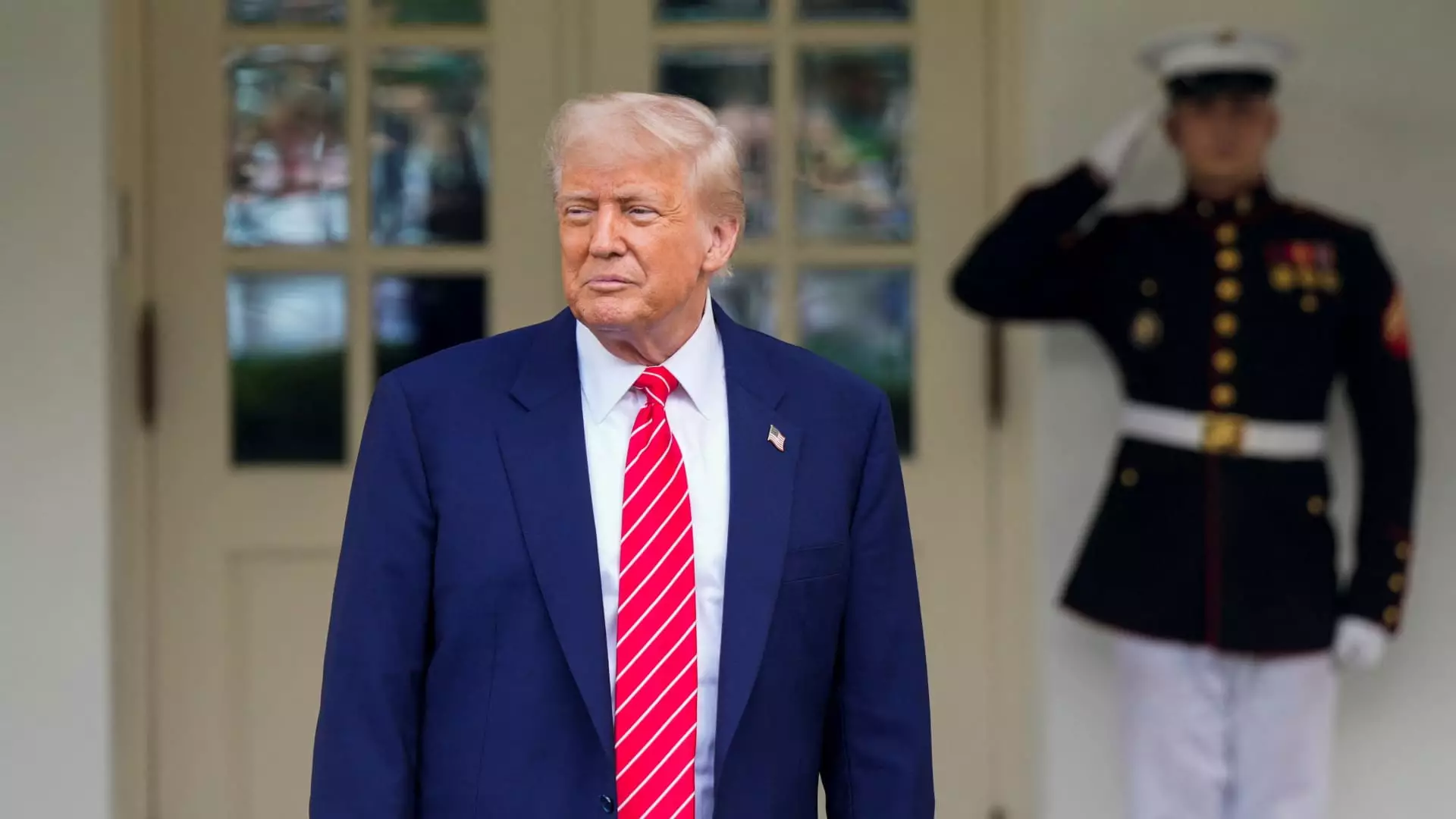

In the chaotic realm of crypto legislation, President Donald Trump has unwittingly become a major roadblock. The recent failure of the GENIUS Act, aimed at establishing federal rules for stablecoins, crystallizes this reality. Concerns have emerged surrounding Trump’s personal involvement in the cryptocurrency market, raising critical issues about conflicts of interest that pervade his administration. As lawmakers raise alarms, they are faced with the daunting task of navigating a legal landscape that is muddled by Trump’s personal business interests.

Senator Jeff Merkley’s remarks underscore the intensity of the situation, branding it as an egregious conflict of interest: “Currently, people who wish to cultivate influence with the president can enrich him personally by buying cryptocurrency he owns or controls.” This is not merely a matter of bad optics; it’s an alleged corrupt scheme that threatens national security and undermines public trust in the government. With bipartisan support veering away from the proposed legislation, it has become clear that Trump’s involvement in crypto is creating significant barriers to essential regulatory advancements.

Stablecoins: The Promise and the Pitfalls

Stablecoins, which tie their value to traditional assets like the U.S. dollar, have garnered attention as potential game-changers in the financial landscape. Their promise lies in providing stability, which could foster greater acceptance and use of cryptocurrencies. However, the political wrangling over effective regulation showcases the urgent need for clarity in this rapidly evolving sector. The GENIUS Act was expected to pave the way for such clarity, forging a path through gridlock that has characterized crypto regulation in recent times.

Nonetheless, Trump’s monetary exploits, particularly his endorsement of meme coins, such as $TRUMP and $MELANIA, add layers of complexity to this issue. These coins have drawn significant attention, fueling speculation and promoting a culture of “pay-for-play” within the political realm, as labeled by Senator Richard Blumenthal. These issues are not trivial; they reflect larger concerns about the integrity of political systems and the possible erosion of ethical standards among elected officials.

Bipartisan Intentions Stymied by Partisan Obstacles

Despite visible support for the GENIUS Act among some Democratic lawmakers, the bill ultimately failed to garner the necessary votes to advance in the Senate. The backdrop of a fractured Congress, with slim majorities and an increasingly unified Democratic front against Trump’s agenda, exacerbates the difficulties in passing legislative initiatives. Nine Democratic senators, previously supportive of the stalled bill, voiced concerns last weekend regarding the need for stronger protections against anti-money laundering and issues surrounding foreign influence, underscoring an urgency for substantial reforms.

Senator Lisa Blunt Rochester’s pointed comments highlight a growing mistrust in Trump’s financial motives. Her concerns, along with calls for more robust provisions, reveal a legislative body wary of potential corruption stemming from the President’s business entanglements. The situation delineates a growing realization that personal pursuit can significantly impact public policy, making it difficult to momentum towards a future of responsible crypto governance.

Impacts on Innovation and Investment

In the face of the stalled legislation, voices from the crypto industry are emerging, expressing frustration at the lack of substantive progress. Ryan Gilbert, founder of Launchpad Capital, encapsulated this sentiment succinctly when he said, “It’s unfortunate that personal business is getting in the way of good policy.” This commentary illustrates a broader concern within the investment community—namely, that Trump’s personal financial ambitions may eclipse necessary advancements within the industry.

The failure of the GENIUS Act marks only the beginning of what could be an arduous journey toward establishing robust crypto regulations. Gilbert warns that if the status quo continues, the United States risks becoming “the laughing stock of the world,” a sentiment that augurs poorly for future investment and innovation. As the reputation of the U.S. crypto sector hangs in the balance, many hope for a re-calibration of priorities that places sound policy over personal profit.

The Call for Ethical Governance

As legislators continue to grapple with these pressing issues, the pressure for ethical governance mounts. The introduction of the “End Crypto Corruption Act” signifies a strong push towards accountability, aiming to place restrictions on the ability of elected officials to engage in cryptocurrency ventures. This legislative effort is not merely a reaction to Trump’s conduct; it reflects growing aspirations for a comprehensive framework that could safeguard the integrity of the cryptocurrency landscape.

While the future of crypto regulation in the U.S. may appear uncertain, the dialogue surrounding these proposals is essential. The demand for ethical considerations in governance cannot be overstated. As voices amplify their concerns, one thing becomes clear: if left unchallenged, the intersections between personal wealth and political power could stifle innovation and tarnish the credibility of an entire industry. The focus must shift from individual gains to the collective interests of society, ensuring that the legacy of crypto evolves in a direction that benefits all.