The landscape of American venture capital is constantly shifting, and an intriguing trend is emerging as we look towards 2025. A number of U.S. unicorns—startups valued at $1 billion or more—are positioned to make their public debuts, signaling a potential resurgence of Initial Public Offerings (IPOs) in the coming years. Insights from the recent PitchBook/NVCA Venture Monitor provide a compelling glimpse into this phenomenon, offering both optimism and caution for investors and entrepreneurs alike.

PitchBook has developed a sophisticated tool known as the VC exit predictor. By employing machine learning techniques on an extensive database of companies and funding rounds, this tool quantifies the probability of startups successfully exiting through acquisition or IPO. Each startup is assigned a percentage score, informing venture capitalists about which companies might outperform the competition. This data-centric approach allows stakeholders to navigate the complexities and uncertainties inherent in the venture capital ecosystem.

Despite the uptick in investments during 2024, PitchBook’s Nizar Tarhuni noted that surface-level excitement, particularly surrounding the numerous high valuations in early-stage AI ventures, belies a more troubling reality: many startups are grappling with challenges that threaten their potential for exit. Issues such as valuation mismatches—where sellers expect higher prices based on inflated previous funding rounds—coupled with regulatory hurdles, have curtailed the appetite for acquisitions and IPOs.

As we approach 2025, the venture capital landscape is marked by both opportunities and significant challenges. The prospect of a more business-friendly regulatory environment in Washington could invigorate both the startup ecosystem and investor confidence, providing much-needed clarity in an otherwise tumultuous market. Tarhuni’s cautious optimism recognizes that the recalibration of expectations about valuations and growth could entice fresh capital into play.

However, the crux of the issue remains: while optimism reigns, ongoing market dynamics present headwinds that cannot be ignored. Fundraising activities could continue to be muted, as investors diversify their portfolios into alternative investments that promise quicker returns, potentially sidelining promising startup ventures.

According to PitchBook’s analysis, numerous tech unicorns appear poised for an IPO by 2025. Notable companies such as Anduril—founded by Oculus creator Palmer Luckey—and Mythical Games, a pioneer in Web3 gaming, have been highlighted as leaders in this movement, each boasting a staggering 97% chance of going public in the upcoming year. Other companies, including Impossible Foods and SpaceX, are also viewed as strong candidates for IPO, showcasing the potent mix of innovation, technological advancement, and market interest.

Bobby Franklin, CEO of the National Venture Capital Association (NVCA), emphasized the potential for political shifts to ameliorate liquidity issues for portfolio companies. Changes in government regulations could streamline operations and reduce burdens, fostering an environment conducive to growth. Furthermore, tax reform currently under discussion could invigorate the venture ecosystem by incentivizing research and development, essential for fostering innovation.

State of the Investment Landscape

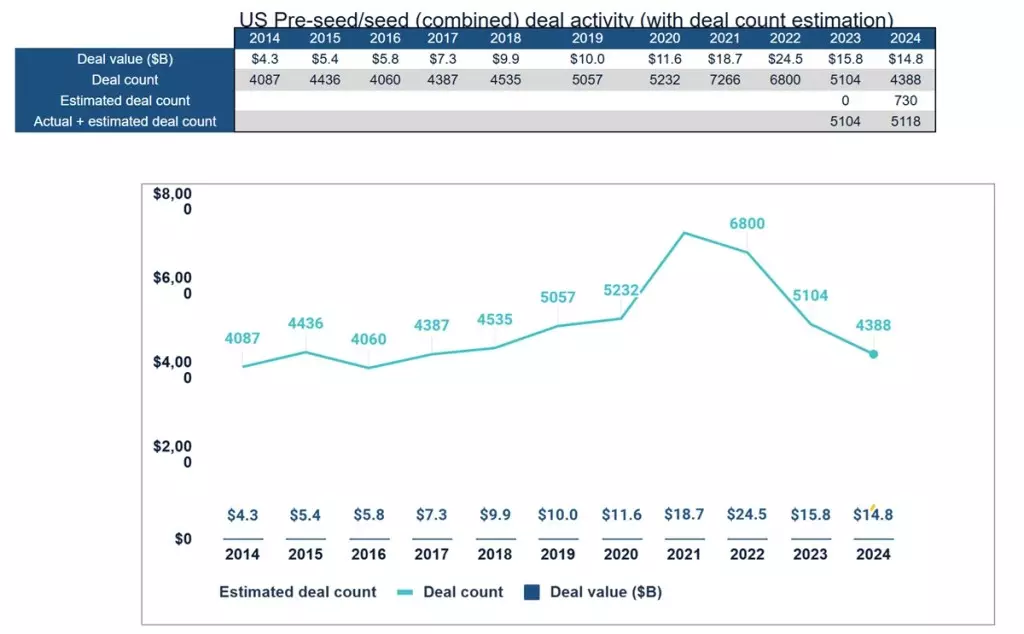

Data from 2024 suggests a decline in the number of deals within certain funding brackets when compared to prior years, signifying a cautious market. The largest category of deal sizes, totaling between $1 million and $5 million, dwindled from a robust peak in 2021. This downward trend illuminates the fierce competition startups face in attracting investment amid a sea of options available to investors.

As 2025 approaches, each of these dynamics suggests that we are at a crucial juncture in venture capital. While a healthy roster of unicorns is readying for potential public offerings, the path to IPO is fraught with obstacles that could dramatically influence their trajectories. Investors and entrepreneurs alike must remain vigilant and adaptive, prepared to navigate the intricacies of this ever-evolving landscape to capitalize on the forthcoming opportunities it presents.

The interplay of optimism and caution suggests a profound transformation is on the horizon for IPOs in 2025. Stakeholders within the venture capital framework would do well to synergize their strategies, leveraging data insights while remaining adaptable to the larger economic and regulatory currents that lie ahead.