As Nvidia prepares to release its fourth-quarter earnings on Wednesday, market watchers are keenly focused on its growth trajectory amid a transformative year for the tech giant. Analysts have set high expectations, with consensus estimates predicting an adjusted earnings per share (EPS) of $0.84 and revenues hitting $38.04 billion. This earnings report is poised to encapsulate a year marked by remarkable fiscal performance and significant milestones, offering insights into the sustainability of Nvidia’s recent success.

Nvidia’s growth story has been nothing short of extraordinary, with a staggering 72% increase in revenue projected for the last quarter. For the fiscal year, Nvidia’s total revenue is anticipated to exceed $130 billion, more than double compared to the previous year. Such explosive growth has been driven predominantly by the booming demand for data center graphics processing units (GPUs), critical for the development and deployment of advanced artificial intelligence solutions, including platforms like OpenAI’s ChatGPT. This correlation between AI advancements and Nvidia’s prosperity underlines the company’s pivotal role in shaping the tech landscape.

Over the past two years, Nvidia’s stock has surged dramatically, at times elevating its market capitalization above $3 trillion. However, this meteoric rise has encountered headwinds, with prices stabilizing at levels comparable to those of last October. As Nvidia’s growth slows, investors are increasingly scrutinizing the company’s strategic direction and its ability to maintain this exceptional pace.

One of the critical issues facing Nvidia heading into its earnings report is the potential tightening of budgets among its primary clients — hyperscale cloud companies. After years of robust capital expenditure, there are emerging signals that these companies may be reassessing their spending plans. Recently, uncertainty arose with the introduction of China’s DeepSeek R1 AI model, challenging existing assumptions about the need for additional Nvidia chips and prompting concerns about potential new export restrictions from the U.S. on AI chip sales to China.

The ramifications of such restrictions could be far-reaching. Nvidia has already faced limitations in exporting its most advanced chips to the region and has created specialized versions of its chips to cater to the Chinese market. Investors will be looking for elucidation on how ongoing geopolitical tensions might impact Nvidia’s supply chains and market access.

In addition to market dynamics, Nvidia faces internal challenges regarding its latest AI chip, Blackwell. There are reports indicating that the rollout of some Blackwell versions may be slower than anticipated due to technical challenges involving overheating and yield issues. Analysts from Morgan Stanley have projected that major players like Microsoft, Google, Oracle, and Amazon will account for a substantial share of the spending on Blackwell chips. However, fresh reports indicating a slowdown in investment commitments from Microsoft, particularly in private data centers, have heightened concerns regarding the longevity of AI infrastructure growth reliant on Nvidia’s products.

Despite these challenges, Microsoft has reassured the market of its intentions to spend significantly on infrastructure in the coming years — a commitment that could ease some investor fears. Concurrently, other major customers, such as Alphabet and Meta, appear to remain on track with their capital expenditure growth, suggesting that Nvidia’s relationships in the cloud sector are still quite robust.

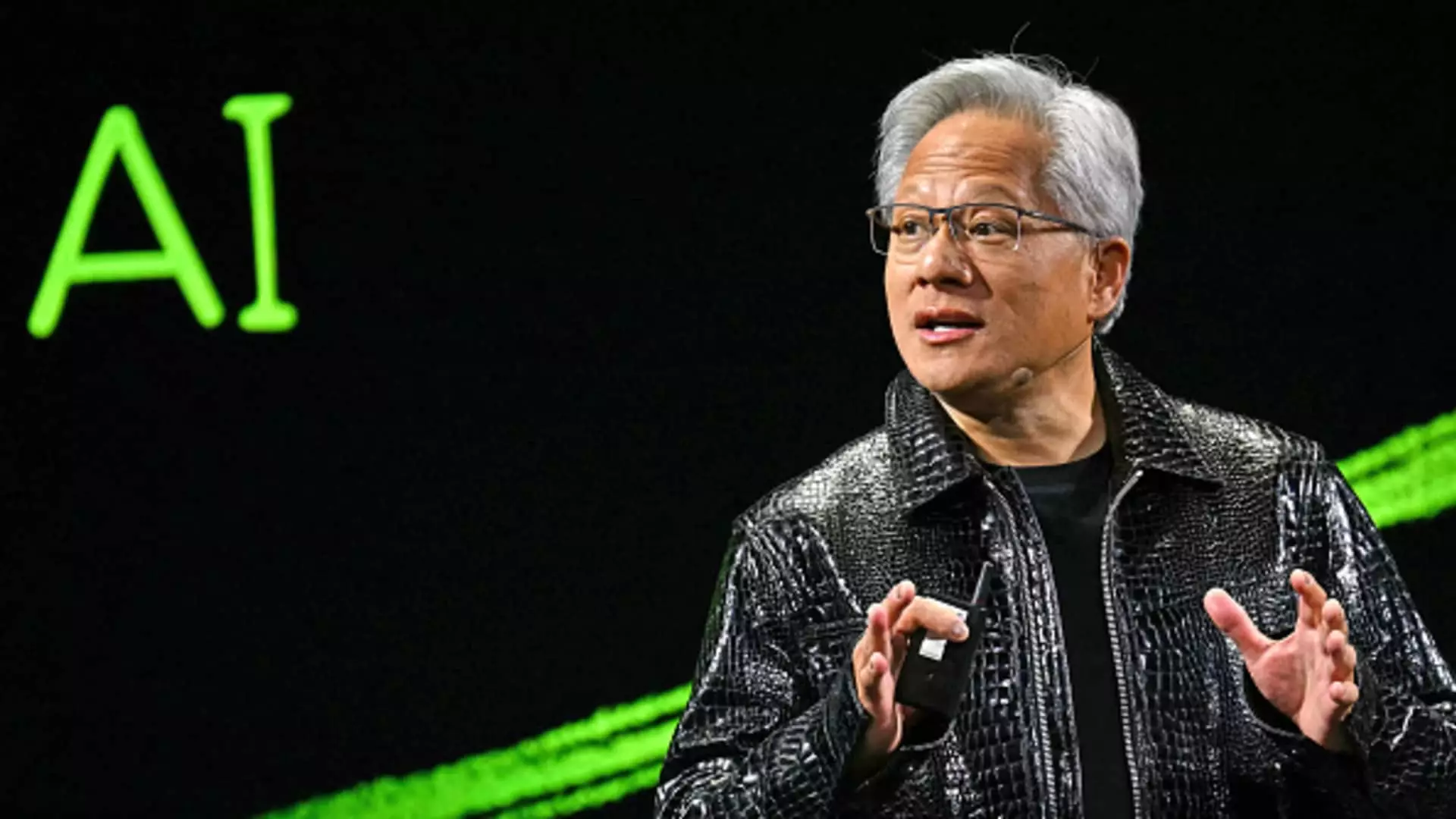

As Nvidia gears up to address these concerns during the earnings call, investors will be eager to hear CEO Jensen Huang’s insights on the current landscape of the AI boom and the future outlook for the company. Guidance on fiscal 2026 will be particularly critical, as investors seek clarity on the expected growth trajectory from last year’s already elevated sales figures.

Analysts expect Nvidia to strike a balance between celebrating its past achievements and addressing the uncertainties that lie ahead. With a price target of $152 set by Morgan Stanley, the outlook remains cautiously optimistic, though the market will closely monitor any indications of strain in Nvidia’s symbiotic relationship with key cloud partners.

Nvidia’s upcoming earnings report arrives at a pivotal juncture, reflecting not only the company’s tumultuous rise but also the multifaceted challenges on the horizon. As the tech landscape continues to evolve, Nvidia’s ability to adapt and thrive will be crucial, making this a moment of both reflection and anticipation for investors and industry stakeholders alike.