Australia is at a pivotal juncture in its energy transformation, where hydrogen production plays a critical role in achieving a net-zero emissions future. As outlined in the newly released National Hydrogen Strategy, this initiative aims to position Australia as a frontrunner in the global shift towards sustainable energy sources. Unveiled by Federal Climate Change and Energy Minister Chris Bowen, the updated strategy seeks to address past shortcomings, adapt to evolving market dynamics, and ensure that the green hydrogen sector can flourish competitively. However, while aspirations are high, the path forward is laden with uncertainties that warrant careful consideration.

The need for a robust hydrogen sector in Australia has never been more urgent. Hydrogen, the universe’s simplest and most abundant element, is poised to be a cornerstone of low-emission technologies. Unlike its conventional production, which relies heavily on natural gas—a process associated with substantial greenhouse gas emissions—green hydrogen is generated through the electrolysis of water, powered by renewable energy sources. This approach paints an optimistic picture for the future of hydrogen production in Australia, yet realizing these ambitions requires overcoming significant barriers.

One of the major challenges highlighted in the new strategy is cost competitiveness. Currently, the cost of producing green hydrogen exceeds what many potential buyers are willing to pay. To counteract this, the strategy proposes ambitious production targets: aiming for 500,000 metric tons annually by 2030 and a staggering 15 million metric tons by 2050. These figures reflect a responsive shift in strategy from earlier iterations, where the previous government’s focus on price targets did not sufficiently factor in the complexities of hydrogen transport and storage.

To direct investments effectively and foster growth in the hydrogen economy, the new strategy emphasizes key sectors ripe for hydrogen integration. Industries such as iron, alumina, and ammonia are identified as focal points for developing export capabilities and reducing carbon footprints. Moreover, it suggests promising applications in aviation, shipping, and freight transportation, areas where hydrogen can offer substantial emissions reductions. This strategic clarity is vital; without it, investors may hesitate to commit resources amid a landscape of uncertainty.

What remains less clear, however, is the specific mechanism by which the government plans to support these priority sectors. Questions linger about whether these industries will receive preferential access to funding and infrastructure. Furthermore, it’s crucial for policymakers to draw a line on continued investments in hydrogen technologies that fail to prove competitive, as taxpayer resources should not be wasted on untenable projects.

While Australia previously focused on exporting liquid hydrogen to Japan and South Korea, the landscape is shifting. With new partnerships emerging, particularly with European nations, there is a push to secure buyers in this lucrative market. A significant A$660 million deal with Germany exemplifies such collaborative efforts. However, the realities of hydrogen transport remain daunting; the infrastructure required to export hydrogen is both complex and expensive.

Despite the allure of international markets, there could be substantial benefits in harnessing hydrogen domestically, particularly in producing green iron from iron ore. Focusing on local consumption could stimulate the economy more sustainably rather than relying heavily on exports that could take years to materialize.

Safety and community engagement are critical components that the updated strategy seeks to address. The potential risks associated with hydrogen—especially regarding public safety concerns surrounding its volatility—were crucial to earlier strategies. The new strategy takes a balanced approach, recognizing the need for effective community consultations and ensuring the benefits of hydrogen production are widely shared, including job creation and economic diversification, especially in regional areas.

Central to this community engagement is the involvement of First Nations people to ensure that their rights and interests are respected as the hydrogen industry expands. This inclusive approach is essential not just for ethical considerations but for securing community support, which is paramount for the long-term sustainability of hydrogen projects.

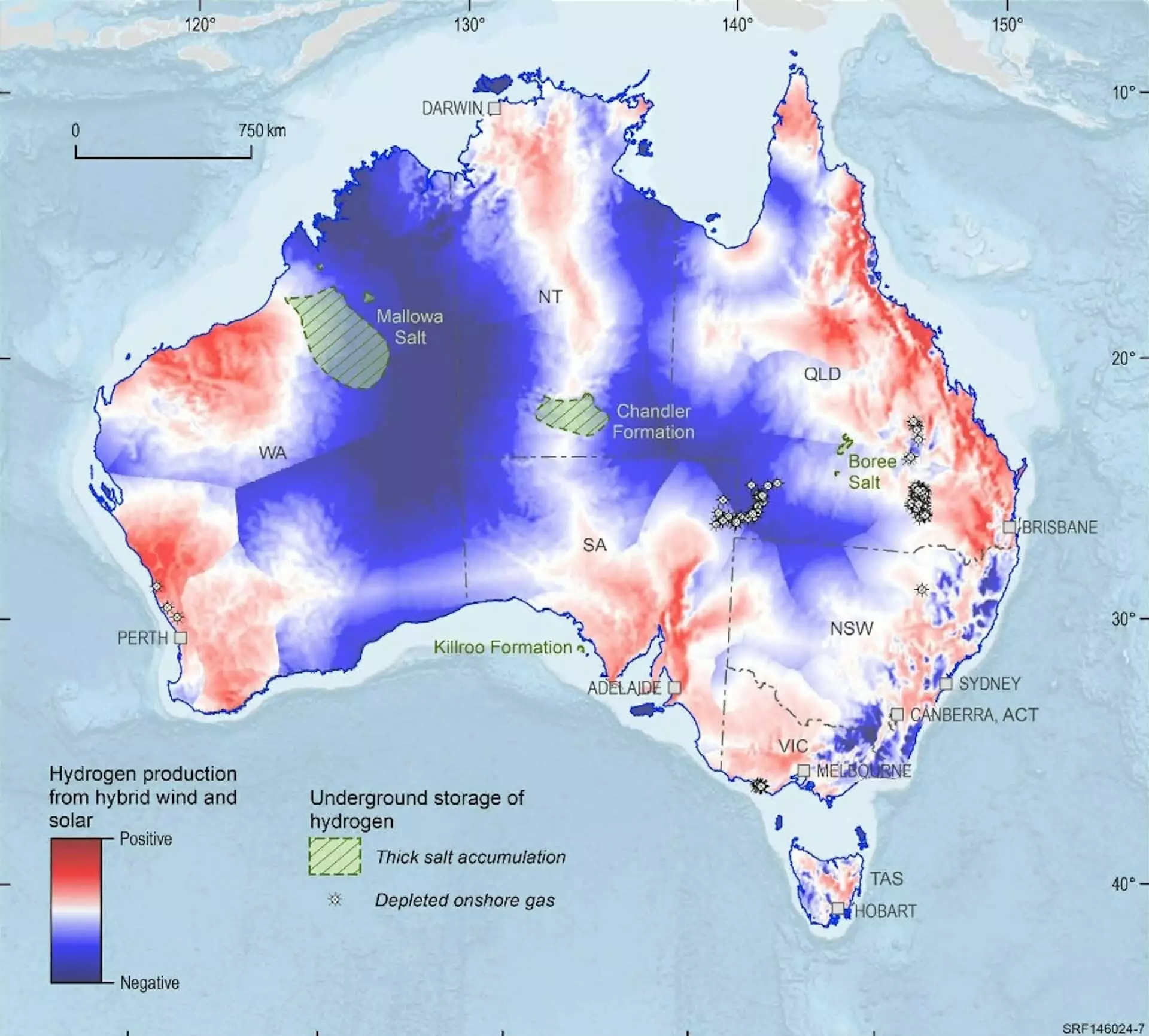

As Australia embarks on this ambitious hydrogen journey, the proof of success will become evident in critical indicators—such as the establishment of large-scale hydrogen projects, multi-year procurement contracts, and the requisite infrastructure to support hydrogen production and storage. The coming years will be instrumental; the strategy is set for review in 2029, while the targets lay the groundwork for the future.

Should progress falter in securing investment and commitment from key industries, Australia’s hydrogen aspirations may require reevaluation. Striking the right balance between ambition and practicality will be pivotal as the nation navigates the complexities of transforming its energy landscape toward a sustainable and prosperous future. In this critical endeavor, clarity, responsiveness, and strategic foresight will be the linchpins that determine the viability of Australia’s hydrogen strategy in the global arena.