In the complex realm of global trade, few substances are more contentious than tariffs, particularly when entwined with the fabric of the technology industry. The recent pivot by U.S. President Donald Trump to backtrack on imposing tariffs on electronics marks a significant moment in the ongoing clash between economic policy and technological advancement. Initially proposed tariffs, which could have rapidly inflated the prices of essential devices like smartphones and laptops, were met with considerable backlash from both consumers and industry leaders alike. With a dizzying array of consumer electronics destined for the U.S. market largely produced in China, the potential rise in costs would have wreaked havoc not just on consumer wallets but also on overall market stability.

Opponents of the tariffs argued that heightening prices could stifle innovation and accessibility to technology—key drivers of the modern economy. The existence of a 145% tariff on certain electronic goods would have contributed to a dire situation where a product like the iPhone might skyrocket from $1,000 to an untenable $3,500 if produced domestically, thereby neglecting the realities of global supply chains. In this landscape, it’s essential to recognize that tariffs may not hold the sway many politicians hope they will. In Trump’s retreat from his previous stance reflects a fleeting recognition of the delicate balance his administration must maintain between policy intentions and market realities.

Investor Sentiments: The Ripple Effect of Uncertainty

Despite these tariff adjustments, the underlying issue remains: can such maneuverings genuinely rekindle investor confidence? Since Trump’s inauguration, the stock market has dipped by 15%, with fluctuations often dictating the rhythm of investment decisions. In a sector as rapidly changing and sensitive as technology, unpredictability can be catastrophic. Investors thrive on stability, and when faced with erratic policymaking and fluctuating trade sentiments, skepticism abounds. Trump’s recent announcements regarding tariffs could merely stall a longer-term trend of market uncertainty without substantive systemic changes to alleviate these deep-rooted challenges.

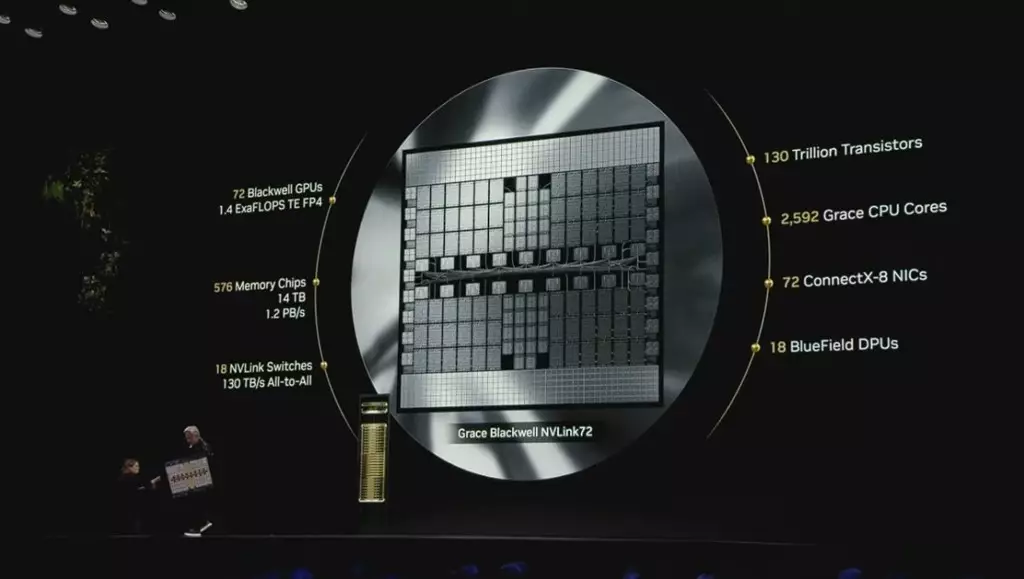

The tech sector, fueled by the immediacy of market demands and consumer expectations, recognizes that immediate tariff amendments may not be a panacea. For instance, industry analysts have pointed out that even as Trump contemplates specific sector tariffs on critical components like semiconductors, the repercussions could extend far beyond immediate costs. Tariffs might not only impact prices but could also obstruct the nexus of innovation, diminished competitiveness, and job creation—factors integral to the longevity of any economy.

Regaining Competitive Edge: Beyond Tariffs to Strategic Investments

A notable aspect of this unfolding narrative is the growing recognition of the importance of investing in domestic capabilities rather than simply imposing tariffs. With the directive from the U.S. Chips and Science Act, there lies a glimmer of hope for companies seeking to enhance domestic manufacturing in conjunction with substantial federal support. However, one cannot overstate the time and resources required to replicate what nations like China have developed over decades. Trump’s ambitions may need to reconcile with the nuanced reality: turning the tide of chip manufacturing, among other sectors, could stretch over years or even decades.

Moreover, there’s a critical need to rethink how the U.S. educates and prepares its workforce. An alarming gap exists when compared to China, where educational infrastructures are producing far more engineers and graduates in STEM fields. The tech industry continues to evolve rapidly, and a highly educated workforce is paramount to maintain the United States’ competitive edge in an increasingly complex global market. Tariffs alone won’t spur advancements in education or research; a strategic overhaul is necessary to cultivate the human capital that drives the technology of tomorrow.

Challenges and Opportunities: Lobbying Influence and Future Directions

The multifaceted nature of the tech industry invites concerns regarding the lobbying influence exerted over policymakers. High-value jobs generated by technology firms are essential, reflecting the pressing need for a skilled workforce. Yet, the challenge persists: can the U.S. not only compete with but outperform nations that are outpacing it in educational output? The administration’s belief in using tariffs as a tool to alter trade dynamics is one thing; effectively reinvigorating American manufacturing and engineering talent is another.

While Trump exudes confidence in securing investments from tech giants like Apple and Nvidia towards reestablishing U.S. manufacturing prowess, such claims merit scrutiny. The reality is that merely attracting capital does not guarantee the rejuvenation of a complex, highly technical industry. Building a resilient domestic ecosystem that can rival foreign markets necessitates a commitment to fostering innovation alongside reforms in educational policies. Only through a holistic strategy—incorporating tariffs, strategic investments, and educational improvements—will the U.S. navigate the turbulent waters of global technology competition successfully.