Robinhood’s recent unveiling of tokenized shares for two high-profile private companies, OpenAI and SpaceX, signifies a brave and innovative step toward reshaping how everyday investors engage with traditionally exclusive markets. By leveraging blockchain technology to fractionalize private equity, Robinhood aims to shatter historical barriers that have kept most retail investors from participating in private markets reserved primarily for institutional or ultra-wealthy players. This approach embodies a strong message of financial democratization—one that could potentially redefine equity ownership norms. However, it also raises critical questions about investor readiness, regulatory complexities, and whether demand will truly reflect the enthusiastic narrative presented.

Europe’s Regulatory Edge Unlocks New Possibilities

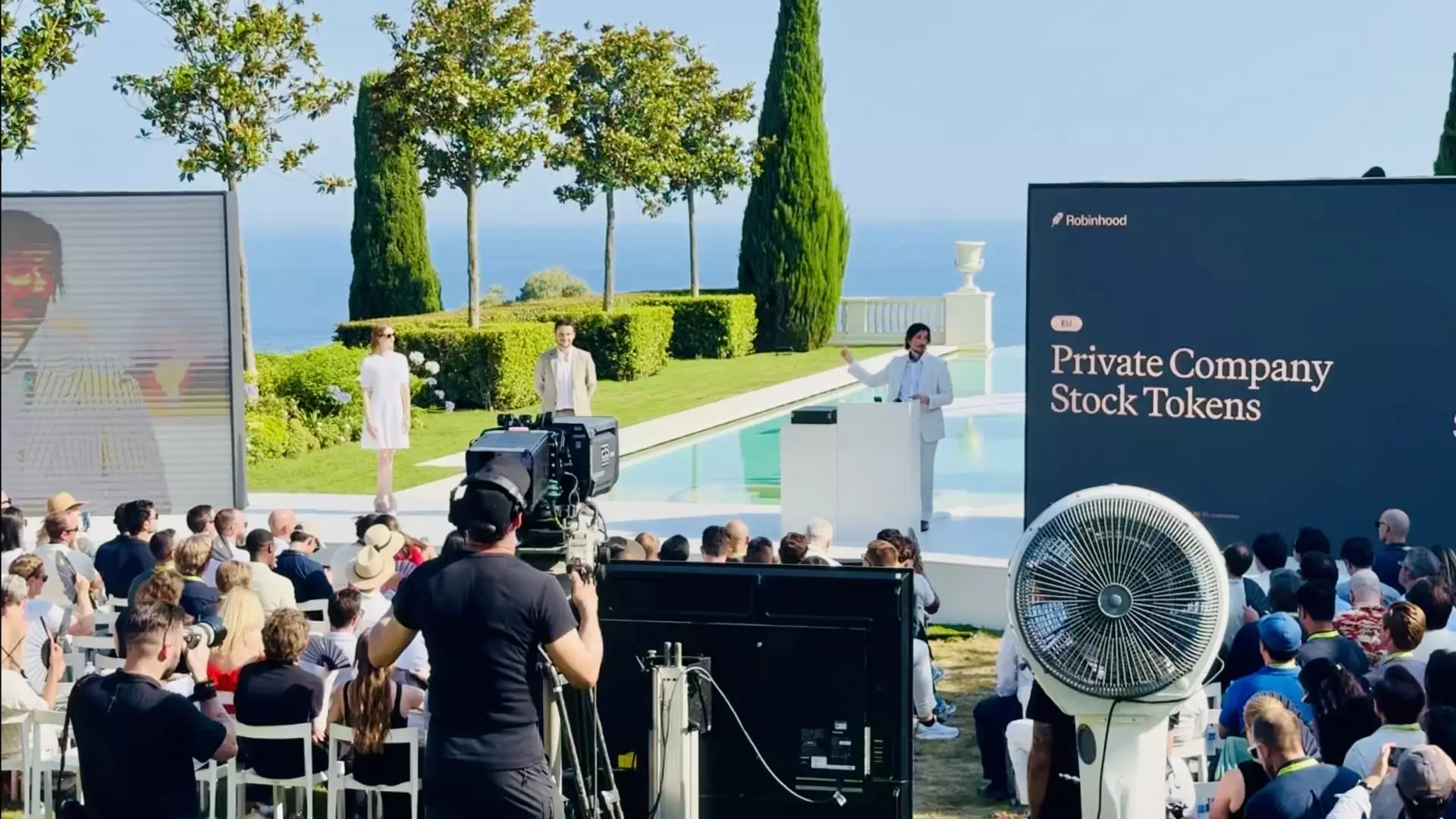

Robinhood’s initial rollout targeting European users seems strategically sound, capitalizing on the EU’s comparatively lenient rules around accredited investor restrictions. Unlike the United States, where regulatory frameworks still create significant compliance challenges, the EU environment enables Robinhood to offer tokenized private equity relatively unrestricted. This regulatory latitude has empowered Robinhood to build an ecosystem where users can actively trade over 200 tokenized stocks and ETFs with no commissions or spreads, alongside the newly introduced private company tokens. While this sounds idealistic, it is crucial to remember that Europe’s regulatory flexibility may not be universally mirrored, limiting the scalability of Robinhood’s vision in global markets, especially the U.S.

Tokenization: A Double-Edged Sword?

Tokenization undeniably brings significant advantages such as 24/5 trading access, fractional ownership, and reduced entry costs, potentially amplifying market liquidity and inclusivity. But this innovative asset format also introduces layers of complexity for individual investors. Tokenized shares of private firms can lack transparency, have limited secondary market liquidity, and carry unique technological risks inherent in blockchain infrastructure. Without proper investor education and robust safeguards, there is a risk that some retail participants might overestimate the ease and safety of investing in tokenized private companies, potentially leading to costly misunderstandings. Robinhood’s promise to “let anyone participate in this economy” is compelling but may be aspirational without stronger investor protections and market education.

U.S. Market Barriers and The Hope for Regulatory Reform

The U.S. market remains an imposing challenge for Robinhood’s tokenization ambitions. The entrenched accredited investor regime continues to bar most retail investors from direct private equity exposure, and the Securities and Exchange Commission’s cautious stance on crypto-related financial products only adds friction. CEO Vlad Tenev’s public calls for regulatory modernization reflect a fundamental tension between innovation and safeguarding retail investor interests. While blockchain technology holds transformative potential to broaden access, it fundamentally clashes with the existing paradigm built around investor accreditation and disclosure standards. Until the regulatory landscape evolves, Robinhood’s U.S. users will remain sidelined from tokenized private equity, dampening immediate enthusiasm in the company’s home market.

Broader Crypto Integration and User Incentives

Beyond tokenized stocks, Robinhood is simultaneously deepening its crypto ecosystem with initiatives like Ethereum and Solana staking, which had previously faced regulatory roadblocks in the U.S. This multi-pronged strategy indicates Robinhood’s commitment to positioning itself as a comprehensive platform blending traditional and digital finance. Offering customers €5 worth of OpenAI and SpaceX tokens as an onboarding incentive is a clever marketing move designed to ignite user interest and drive adoption. However, incentives alone won’t guarantee sustained engagement. The company must prove that these tokenized assets offer genuine value, viable liquidity, and seamless usability over time to maintain user trust and enthusiasm.

Balancing Innovation with Pragmatism

Robinhood’s tokenization breakthrough is undeniably headline-worthy, offering a tantalizing vision for the future of investing. Despite this, the company risks overestimating retail appetite for private company tokens amid ongoing uncertainties about regulation, market depth, and real-world usability. The leap to tokenize private equity is as ambitious as it is fraught with challenges—from technological reliability of blockchain custody wallets to user comprehension of token risks. Ultimately, Robinhood’s experiment could serve as a valuable test case, but success will require measured execution, rigorous compliance, and investor education rather than reliance on hype or regulatory loopholes. The company’s real challenge lies not just in launching novel products but in sustaining a genuinely inclusive investment environment that benefits a broad spectrum of market participants.