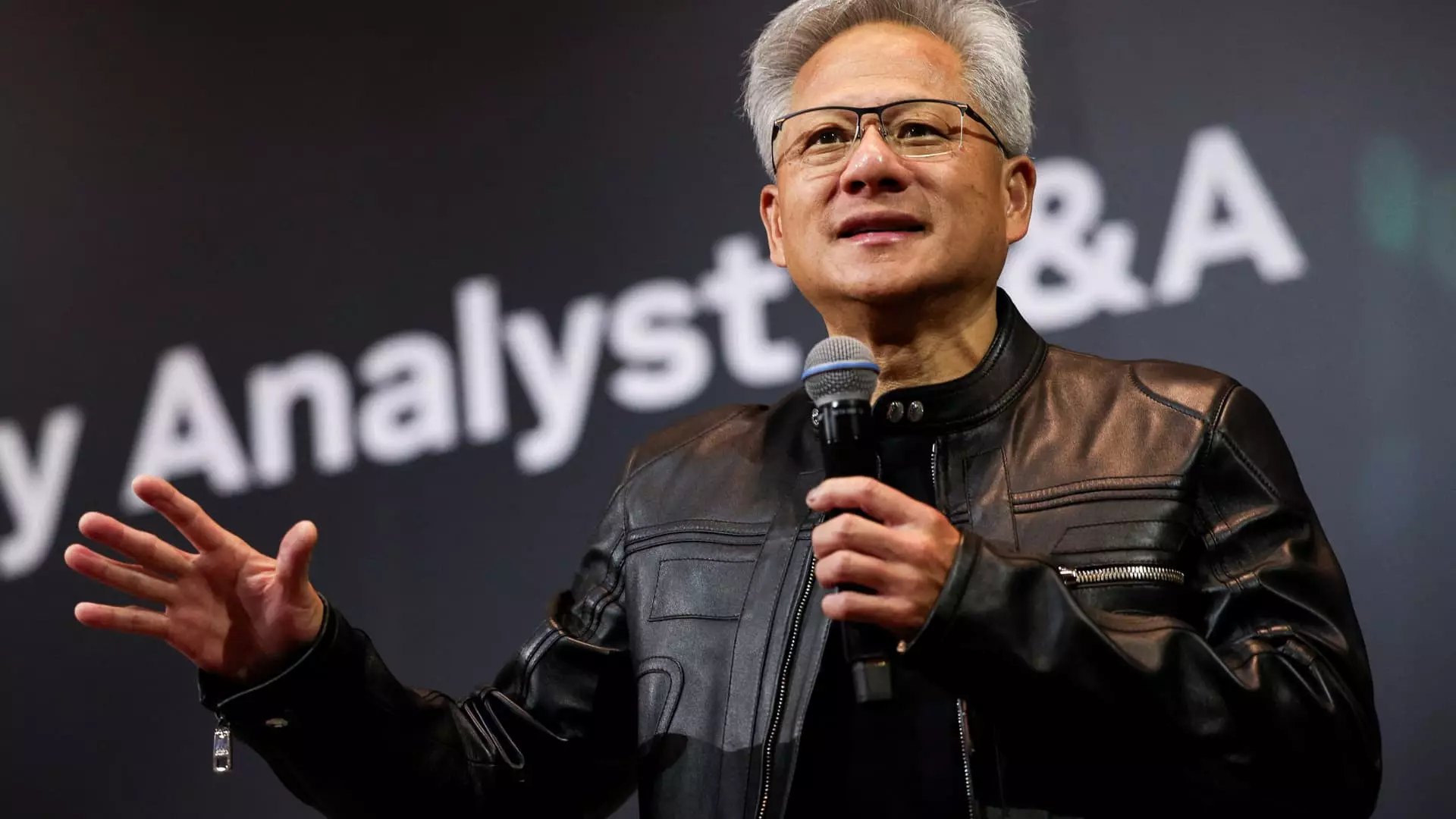

In a landscape defined by technological ingenuity and geopolitical maneuvering, few moments capture the seismic shifts as profoundly as Nvidia’s recent actions and statements surrounding Taiwan Semiconductor Manufacturing Co. (TSMC). During his visit to Taiwan, Nvidia CEO Jensen Huang did not merely praise TSMC; he heralded it as one of the greatest companies in human history, casting a long shadow over the ongoing debates about global supply chain dominance, strategic investments, and technological sovereignty. This moment reveals a strategic pivot that could reshape the semiconductor industry and influence international power dynamics significantly.

The admiration Huang expressed signals more than corporate camaraderie—it’s a declaration of strategic alignment and a statement of recognition for TSMC’s unparalleled role in the global supply chain. As the world grapples with supply chain vulnerabilities exposed during recent crises, the emphasis on TSMC’s technological prowess underscores the company’s centrality in the future of chip manufacturing. Nvidia’s reliance on TSMC’s manufacturing capacity for its next-generation AI chips emphasizes how integrated and critical the Taiwanese firm has become—highlighting a delicate balance of dependency and opportunity in this high-stakes game.

It is important to criticize the narrative that heralds TSMC as an infallible titan. While undeniably a technological marvel, the over-reliance on a single global entity raises concerns about geopolitical leverage and systemic risk. Yet, Nvidia’s open praise and intentions to deepen collaboration demonstrate a strategic recognition: dominance in the semiconductor industry is no longer solely about innovation but also about geopolitical positioning and investment security.

Strategic Investments and the US’s Shift Toward Technological Sovereignty

Amidst these developments, the United States’ efforts to stake its claim within the semiconductor arena become more apparent. The CHIPS Act, a substantial legislative effort aimed at revitalizing U.S. leadership in chip manufacturing, appears to be less about fostering organic growth and more about strategic positioning. The signal from the Biden administration and the Department of Commerce to acquire stakes in leading firms like TSMC, Micron, and Samsung suggests a pivot toward active industrial intervention.

Such interests raise fundamental questions: Should national governments treat strategic industries as assets to be controlled, or should they support open innovation and global collaboration? Nvidia’s CEO’s endorsement of TSMC seems to lean toward the former, highlighting a tacit endorsement of a global supply chain that is, nonetheless, fundamentally intertwined with national interests. The announced expansion of TSMC’s US facilities, fortified with billions under the CHIPS Act, embodies this duality: fostering domestic manufacturing while remaining deeply intertwined with Taiwanese/Asian supply chains.

Critics might argue that government stakes could distort market competition, skew innovation incentives, and entrench geopolitical rivalries. However, it is hard to deny that in an era of growing geopolitical tensions, strategic investment—whether through partnerships, government stakes, or international collaboration—serves as a safeguard for technological sovereignty. Nvidia’s own expansion plans, such as the upcoming “NVIDIA Constellation” office in Taiwan, are emblematic of this shift: companies aiming to build a resilient, geographically diverse operational footprint that maximizes strategic flexibility.

The Future of U.S.-China Tech Rivalry and Global Supply Chains

The current dynamics reveal an increasingly complex chessboard, where geopolitical tensions blur the lines between cooperation and confrontation. Nvidia’s recent request for component suppliers to halt manufacturing related to its China-bound H20 chips, after Beijing raised security concerns, exemplifies how national security priorities are now directly impacting business strategies. The situation with China underscores a broader pattern: export controls, security concerns, and geopolitical rivalries are reshaping global supply chains in a way that could be more disruptive than beneficial.

This interplay between technological development and geopolitical strategy leaves many wondering: can the global semiconductor industry maintain a fragile balance amidst rising tensions? Nvidia’s reliance on suppliers like Foxconn and its efforts to navigate Chinese security concerns reveal a company caught in the crossfire of global power struggles. Meanwhile, China’s freeze on local companies’ access to certain chips demonstrates how security concerns are used as leverage in the larger geopolitical contest.

The role of Taiwan, as both a technological hub and a geopolitical flashpoint, cannot be overstated. Its strategic importance makes it a prime candidate for both partnership and conflict. Nvidia’s statements about growing its Taiwanese workforce and building new offices reflect Taiwan’s importance in the global supply chain but also highlight the risks of geopolitical entanglement. The industry must grapple with whether dependence on Taiwan’s manufacturing backbone exposes the global economy to undue risk or whether it offers a path to technological leadership.

Nvidia’s praise of TSMC and its expansion plans illuminate an industry at a crossroads: one where strategic relationships, geopolitical considerations, and technological innovation are inextricably linked. Consumers and governments alike must grapple with the reality that the future of tech leadership is not merely a matter of innovation but also a matter of strategic positioning in an increasingly fractured global landscape. As the chips fly and alliances form, the true question remains: who will control the digital future, and who will be left behind?